Expert Strategies for Managing Your Cash Advance Effectively

The Ins and Outs of Loans: Browsing Your Financing Choices With Self-confidence

Maneuvering the facility landscape of loans calls for a clear understanding of numerous kinds and crucial terminology. Many people locate themselves bewildered by alternatives such as individual, automobile, and trainee loans, in addition to key ideas like rate of interest and APR. A grasp of these fundamentals not just aids in assessing monetary demands yet additionally improves the loan application experience. There are substantial aspects and common pitfalls that debtors ought to recognize prior to proceeding better.

Recognizing Various Sorts Of Loans

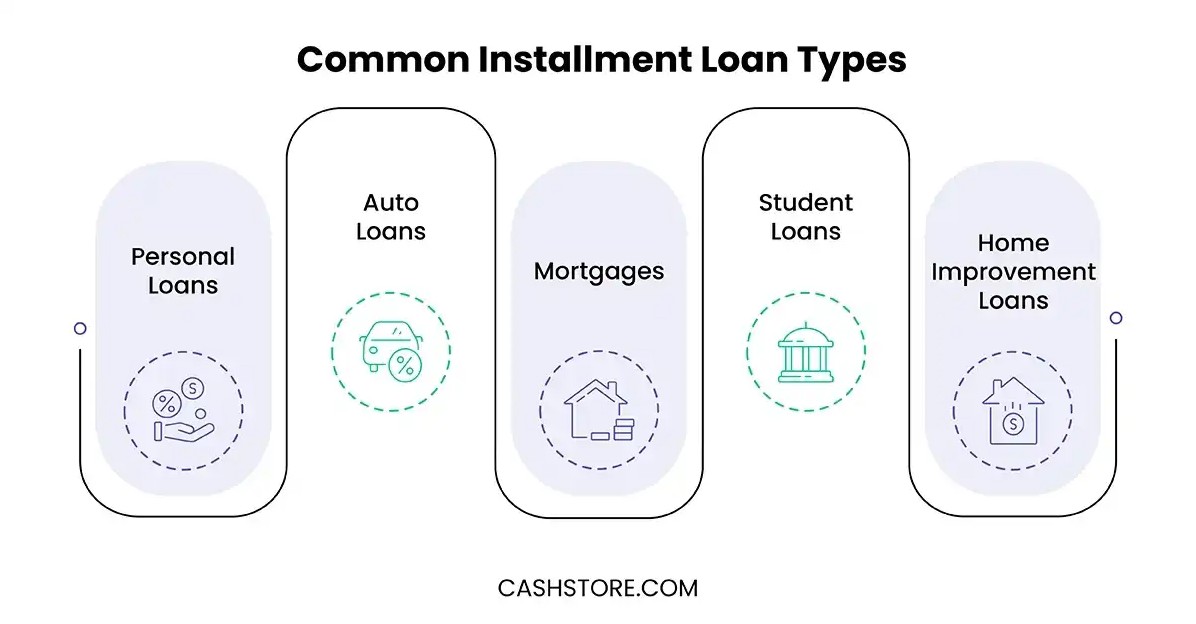

Loans offer as necessary economic tools that satisfy different demands and goals. Individuals and organizations can choose from several sorts of loans, each developed to fulfill particular needs. Personal loans, often unprotected, provide debtors with funds for various personal expenditures, while auto loans allow the acquisition of vehicles with protected financing.

Mortgage, or home mortgages, assist purchasers in acquiring residential or commercial property, typically including lengthy repayment terms and certain rate of interest. Trainee loans, aimed at moneying education, commonly featured lower rate of interest and deferred settlement options until after college graduation.

For companies, industrial loans supply necessary capital for growth, tools acquisitions, or functional expenses. Additionally, payday advance give quick cash money solutions for urgent requirements, albeit with higher rates of interest. Recognizing the different types of loans enables borrowers to make educated choices that straighten with their economic objectives and situations.

Secret Terms and Ideas You Must Know

When maneuvering loans, comprehending crucial terms and ideas is vital. Rates of interest play a crucial function in establishing the expense of loaning, while various loan types deal with various economic demands. Knowledge with these components can equip individuals to make educated decisions.

Passion Prices Described

How do rate of interest influence loaning choices? Rate of interest represent the cost of obtaining cash and are an essential aspect in monetary decision-making. A higher passion price enhances the overall price of a loan, making borrowing less enticing, while lower prices can incentivize debtors to take on debt. Lenders usage rate of interest to mitigate danger, reflecting customers' creditworthiness and dominating economic problems - Cash Advance. Dealt with rates of interest continue to be continuous throughout the loan term, supplying predictability, whereas variable rates can change, potentially leading to greater payments gradually. Furthermore, comprehending the yearly percent rate (APR) is important, as it encompasses not just passion but also any linked fees, supplying an extensive sight of loaning expenses

Loan Enters Review

Maneuvering the landscape of loan kinds is vital for borrowers seeking one of the most ideal financing choices. Recognizing various loan types helps individuals make notified choices. Individual loans are typically unsafe, ideal for combining financial obligation or funding personal projects. Mortgages, on the other hand, are protected loans specifically for acquiring realty. Auto loans serve a similar function, funding car acquisitions with the automobile as collateral. Service loans accommodate business owners requiring resources for operations or expansion. Another option, student loans, assist in covering academic costs, usually with desirable repayment terms. Each loan type offers unique terms, interest rates, and qualification standards, making it crucial for borrowers to assess their monetary requirements and abilities before committing.

The Loan Application Refine Discussed

What steps must one require to efficiently browse the loan application process? First, individuals should analyze their monetary demands and figure out the type of loan that lines up with those needs. Next, they ought to evaluate their credit scores report to validate precision and recognize areas for improvement, as this can influence loan terms.

Following this, customers have to collect required documentation, including evidence of revenue, employment history, and monetary statements. As soon as prepared, they can approach lending institutions to ask about loan products and rates of interest.

After choosing a lender, completing the application accurately is important, as mistakes or noninclusions can delay processing.

Candidates need to be prepared for possible follow-up requests from the lending institution, such as added documentation or information. By adhering to these steps, individuals can improve their chances of a smooth and effective loan application experience.

Variables That Impact Your Loan Authorization

When thinking about loan authorization, numerous important elements enter play. 2 of one of the most significant are the credit rating score and the debt-to-income ratio, both of which supply lenders with insight into the consumer's economic stability. Understanding these components can greatly improve an applicant's possibilities of safeguarding the desired financing.

Credit Score Significance

A credit score functions as a crucial criteria in the loan authorization procedure, affecting lending institutions' assumptions of a customer's monetary dependability. Normally varying from 300 to 850, a greater score suggests a history of accountable debt usage, including timely settlements and reduced credit history application. Numerous aspects contribute to this score, such as settlement background, length of credit report history, kinds of credit scores accounts, and recent credit report queries. Lenders make use of these ratings to analyze danger, figuring out loan terms, rate of interest prices, and the likelihood of default. A solid credit rating not only improves authorization opportunities yet can likewise result in more favorable loan problems. On the other hand, a low rating might cause greater interest prices or rejection of the loan application completely.

Debt-to-Income Proportion

Lots of loan providers consider the debt-to-income (DTI) ratio a vital facet of the loan approval procedure. This official website economic statistics compares a person's monthly financial debt payments to their gross monthly earnings, providing insight right into their ability to handle added financial obligation. A reduced DTI proportion suggests a much healthier financial scenario, making borrowers much more attractive to loan providers. Factors influencing the DTI proportion consist of real estate expenses, charge card equilibriums, pupil loans, and other reoccuring expenses. Furthermore, adjustments in income, such as promos or work loss, can significantly influence DTI. Lenders typically like a DTI proportion below 43%, although this threshold can vary. Comprehending and managing one's DTI can boost the chances of securing positive loan terms and rates of interest.

Tips for Managing Your Loan Responsibly

Usual Errors to Prevent When Securing a Loan

Furthermore, numerous individuals rush to approve the initial loan offer without comparing alternatives. This can cause missed out on possibilities for better terms or reduced prices. Borrowers should also avoid taking on loans for unnecessary costs, as this can lead to long-lasting financial debt problems. Overlooking to analyze their credit rating score can hinder their capacity to safeguard desirable loan terms. By recognizing these challenges, consumers can make enlightened decisions and browse the loan procedure with higher confidence.

Frequently Asked Questions

Just How Can I Improve My Credit Score Prior To Looking For a Loan?

To improve a credit score before looking for a loan, one need to pay expenses in a timely manner, decrease impressive financial obligations, inspect debt records for errors, and avoid opening brand-new charge account. Constant financial behaviors generate positive outcomes.

What Should I Do if My Loan Application Is Rejected?

Exist Any Type Of Costs Connected With Loan Early Repayment?

Loan prepayment charges might use, depending upon the loan provider and loan type. Some loans include charges for early payment, while others do not. It is vital for customers to evaluate their loan agreement for details terms.

Can I Bargain Loan Terms With My Lender?

Yes, borrowers can negotiate loan terms with their loan providers. Variables like credit report, settlement background, and market conditions may influence the lending institution's readiness to customize rate of interest, settlement routines, or charges related to the loan.

Just How Do Passion Prices Impact My Loan Payments With Time?

Rates of interest considerably affect loan payments. Greater prices lead to increased month-to-month payments and overall interest costs, whereas reduced rates reduce these expenses, eventually affecting the consumer's overall monetary burden throughout the loan's period.

Many people find themselves bewildered by alternatives such as personal, automobile, and pupil loans, as well as crucial concepts like rate of interest prices and APR. Interest rates play an essential function in figuring out the cost of loaning, while various loan kinds cater to various monetary demands. A higher rate of interest rate boosts the total cost of a loan, making borrowing less attractive, while reduced prices can incentivize borrowers to take on financial obligation. Repaired passion rates remain continuous throughout the loan term, using predictability, whereas variable rates can fluctuate, potentially leading to higher repayments over time. Financing prepayment charges might use, depending on the lending institution and loan type.